Global Utility Drones Market Set to 3,156.3 Million by 2034 With Integrated Inspection Systems

Utility Drones Market to grow from USD 1,149.6 Million in 2026 to USD 3,156.3 Million by 2034, driven by reliability demands and digital integration.

Utility drones are transitioning from pilot projects to integral inspection systems and will redefine reliability and risk management across utility infrastructure.”

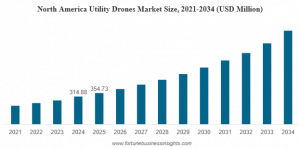

PUNE, MAHARASHTRA, INDIA, February 5, 2026 /EINPresswire.com/ -- The global utility drones market is experiencing rapid expansion and is projected to sustain strong growth through the forecast period, according to a new research report published by Fortune Business Insights™. The global utility drones market was valued at USD 1,017.4 million in 2025 and is expected to increase from USD 1,149.6 million in 2026 to USD 3,156.3 million by 2034, exhibiting a compound annual growth rate (CAGR) of 13.5% during the forecast period.— Fortune Business Insights

This robust growth reflects the increasing reliance on unmanned aerial vehicles (UAVs) by utility companies to perform critical inspection, maintenance, monitoring, and reporting tasks more efficiently and cost-effectively than traditional methods. As infrastructure ages and demand for reliable energy, telecommunications, and utility services grows, utility companies are intensifying efforts to modernize inspection processes and enhance operational safety and effectiveness.

Utility drones unmanned aircraft systems equipped with sensors, cameras, GPS, and advanced data-processing tools are now widely deployed across energy & power, oil & gas, telecommunications, and utilities sectors. Their ability to capture high-resolution imagery, thermal data, and LiDAR scans enables detailed asset evaluation at scale and supports evidence-based maintenance, vegetation management, emergency response, and regulatory compliance activities across vast networks of lines, towers, pipelines, and grid infrastructure.

Get a Free Sample of this Report: - https://www.fortunebusinessinsights.com/enquiry/request-sample-pdf/utility-drones-market-113345

Market Drivers and Growth Factors

The utility drones market is driven by multiple intersecting factors that underscore operational efficiency, safety, and financial performance. Rising expectations for grid reliability and uninterrupted service delivery are compelling utilities to adopt drone technologies for frequent inspections, rapid post-event assessments, and thorough condition monitoring. Extreme weather events, wildfire risk, and heightened scrutiny from regulators and insurers are intensifying the need for proactive asset monitoring strategies that provide clear, audit-ready documentation of infrastructure conditions.

Drones offer a cost-effective alternative to traditional inspection approaches such as ground patrols and helicopter flights. By enabling frequent, repeatable, and remote assessments, drones help utilities reduce labor risk, lower operational costs, minimize exposure to live conductors or hazardous terrain, and expand inspection coverage without proportionally increasing field crews. Additionally, labor shortages among skilled technicians are motivating utilities to leverage drone platforms to augment workforce productivity and reallocate technical resources toward higher-value tasks.

Advances in regulatory frameworks — including progress toward broader Beyond Visual Line of Sight (BVLOS) permissions and unmanned traffic management systems — are making long-distance corridor inspections operationally viable in more regions. These regulatory developments expand the range of utility drone applications, particularly in linear infrastructure inspection such as transmission lines and long-distance pipelines.

Market Trends

A key trend highlighted in the report is the transition from one-off pilot drone flights to integrated utility inspection systems embedded within everyday operations. Utility companies are standardizing drone missions for corridor patrols, substation inspections, vegetation assessments, and post-event damage surveys. The emphasis has shifted toward repeatability, auditability, and scalability rather than sporadic visual inspections.

Increasingly, the value in drone deployment is concentrated in software and data workflows rather than simply airframes. Utilities are adopting standardized payload stacks — including RGB cameras, thermal sensors, and LiDAR — combined with AI-enabled defect detection and automated reporting. Emerging solutions such as docked or “drone-in-a-box” systems are gaining traction at substations and depots, enabling scheduled or event-triggered flights without on-site crews. These approaches embed drones as a permanent sensing layer within utility digital ecosystems, feeding GIS, asset management, and predictive maintenance systems with structured data that supports strategic decision-making.

Ask for Customization: - https://www.fortunebusinessinsights.com/enquiry/customization/utility-drones-market-113345

Market Segmentation

The utility drones market is segmented by end-use industry, payload capacity, drone type, and application, each reflecting distinct patterns of demand and technological requirements.

By End-Use Industry

Among the end-use segments, energy & power captured the largest market share in 2025. Utilities in this sector face increasing obligations to maintain grid reliability amid aging infrastructure, higher load demand, and climate-related risks. Drones enable efficient inspection of high-voltage lines, substations, and renewable assets while reducing dependence on manual inspections and costly helicopter operations.

The telecommunications segment is also poised for strong growth, with a projected CAGR of 14.4% during the forecast period. As telecom infrastructure expands — including towers, fiber networks, and 5G deployments — drones are used to inspect equipment, assist with maintenance planning, and support network deployment strategies.

By Payload Capacity

Based on payload capacity, the lightweight drones segment dominated the market in 2025 and is expected to retain its lead in 2026, capturing more than half of the total share. These drones are cost-effective, easy to deploy, and capable of performing routine visual and thermal spot inspections without extensive logistical requirements.

The medium weight drones segment is forecast to register a strong CAGR of 14.5% over the forecast period, driven by increasing demand for extended endurance, higher payloads, and integrated sensing systems.

By Drone Type

In terms of drone type, rotary-wing drones held the largest market share in 2025. Their vertical take-off and landing capabilities and maneuverability allow them to operate effectively in confined spaces and challenging environments, making them especially suited to tower, substation, and infrastructure inspections. The hybrid drones segment is also expected to grow at a CAGR of 14.4%, benefiting from designs that combine hover flexibility with longer range capabilities.

By Application

Among application segments, power line inspection maintained the largest share in 2025 and is anticipated to lead in 2026. Utility drones equipped with advanced sensors capture detailed visual, thermal, and LiDAR data of power line hardware, conductors, and insulators, enabling proactive maintenance, wildfire risk mitigation, outage reduction, and documented compliance reporting.

The vegetation management segment is also expected to witness strong growth, projected to expand with a CAGR of 15.8% during the forecast period. Effective vegetation management is critical for minimizing outage risk and complying with safety standards, and utility drones are increasingly applied to monitor and manage vegetation encroachment along rights-of-way.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.